The Green Finance Facility (GFF) UN Joint Programme has established a new financing mechanism that provides affordable finance for small and medium-sized enterprises and households of marketable but underserved target groups.

The programme worth $46 million is financed by the Joint SDG Fund, the Government of the Republic of North Macedonia and the European Bank for Reconstruction and Development (EBRD). It is based on strong partnerships between UN agencies, international financial institutions (IFIs), the Government and private sector, with blended finance from public and private sources for green loans and performance-based grants for renewable energy (RE) and energy efficiency (EE) investments toward green transition in North Macedonia. Under coordination of the UN Resident Coordinator in North Macedonia, UNDP is the lead implementing agency with UNECE, the International Organization for Migration (IOM) and EBRD as implementing partners.

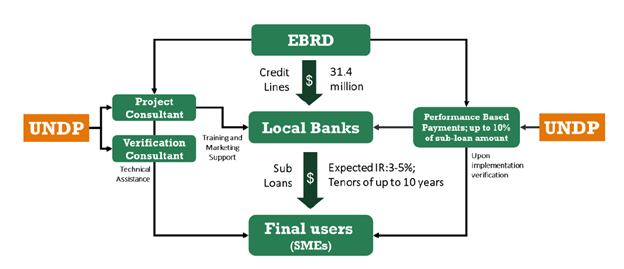

Within GFF, EBRD provides finance ($30m) to local banks (currently signed contracts with Sparkasse Bank, ProCredit Bank) and leasing companies to on-lend to small and medium-sized enterprises (SMEs). As part of the package, the GFF through the partner financial institutions will provide ex-post, performance-based payments of up to 10 per cent of the loan principal for SMEs (Figure 9).

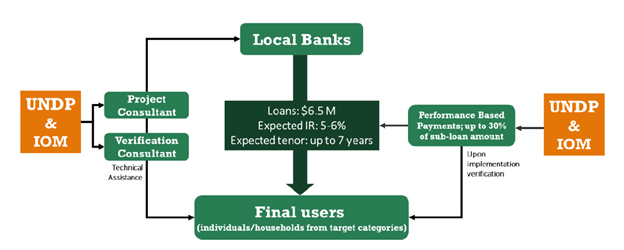

In addition, UNDP provides support to five of the target groups of creditworthy but underserved individuals or households: female-headed households, single parents, households with persons with disabilities (PWDs), Roma households and households affected by Covid-19. IOM provides supports to two additional target groups: returning migrants and remittance recipients, to invest in RE and EE. GFF will provide 30 per cent of the loan principal in ex-post, performance-based payments for target groups of households or individuals (Figure 10).

One additional specific feature of this UN joint programme is the provision of technical support. Namely, GFF has engaged teams of project consultants and verification consultants/ independent assessors, who will work with the banks and with clients. Project consultants will provide technical assistance to the banks and loan recipients supporting the project design process to ensure that projects align with the investment criteria. Verification consultants/ independent assessors will ensure that funded investments have been completed according to the original investment plans. UNECE has already provided technical assistance to the consultants’ teams on design and verification of EE and RE projects.

The project is expected to demonstrate the effectiveness of the Green Finance Facility model in North Macedonia, which serves as a use-case and model to Governments, financial institutions, investors, and others in the region. GFF has been designed with the view for scaling and replicating across the Western Balkans and even to other regions, after a successful implementation.

Furthermore, the project aims to catalyse impact beyond a one-off project investment using a combination of market push and pull activities that address barriers to the adoption of renewable energy and energy-efficient solutions. Ultimately, the project should drive a paradigm shift through the establishment of a mechanism and a standard for financing and adoption of RE and EE solutions.

In North Macedonia, more than 60 per cent of electricity generation is coal-fired30. Furthermore, only a small percentage of the population are utilizing renewable energy and energy-efficiency solutions. Combined, these factors contribute to significant greenhouse gas emissions (7.5 million tons from the burning of fossil fuels31) and high levels of air pollution. Enabling access to affordable financing for renewable energy and energy efficiency solutions in the country will significantly contribute to advancements towards SDG 7 and SDG 13.

(30) SDG Voluntary National Review July 2020

(31) National GHG inventory, December 2020

The Green Finance Facility UN joint programme will be implemented until April 2026 and is expected to result in 70,068 megawatt hours of annual energy savings, 80,510 tons of CO2-equivalent emissions avoided, and 10.7 megawatts in new renewable energy capacity.

Originally published by UNECE.

Note:

All joint programs of the Joint SDG Fund are led by UN Resident Coordinators and implemented by the agencies, funds and programmes of the United Nations development system. With sincere appreciation for the contributions from the European Union and Governments of Belgium, Denmark, Germany, Ireland, Italy, Luxembourg, Monaco, The Netherlands, Norway, Portugal, Republic of Korea, Saudi Arabia, Spain, Sweden, Switzerland and our private sector funding partners, for a transformative movement towards achieving the SDGs by 2030.