Finance

Developing a new wave of financing strategies and creating market opportunities for scaling up SDG investment. The Fund supports countries in advancing the Agenda 2030 by helping to reinforce their SDG financing ecosystem and catalyzing strategic investments that unlock public and private capital towards the Global Goals.

OUR STRATEGY

COVID-19 has disrupted economic and societal patterns in ways unseen in our lifetime. If progress toward the SDGs was already falling short before COVID-19, vulnerabilities and inequalities have now been further exacerbated. Securing enough resources remains a major challenge, with developing countries facing a growing financing gap estimated at US$ 4.2 trillion per year. Capital and wealth, mostly private, do not or cannot reach the geographies and people that need it the most. This is despite the world has theoretically never been as rich as it is today. Achieving the Agenda 2030 demands policy shifts and a major realignment investment decisions by countries, companies, and individuals. The Joint SDG Fund activates financing levers as accelerators for the achievement of the SDGs. With 79 SDG Financing joint programmes we forge paths and partnerships to unlock capital under the:

-

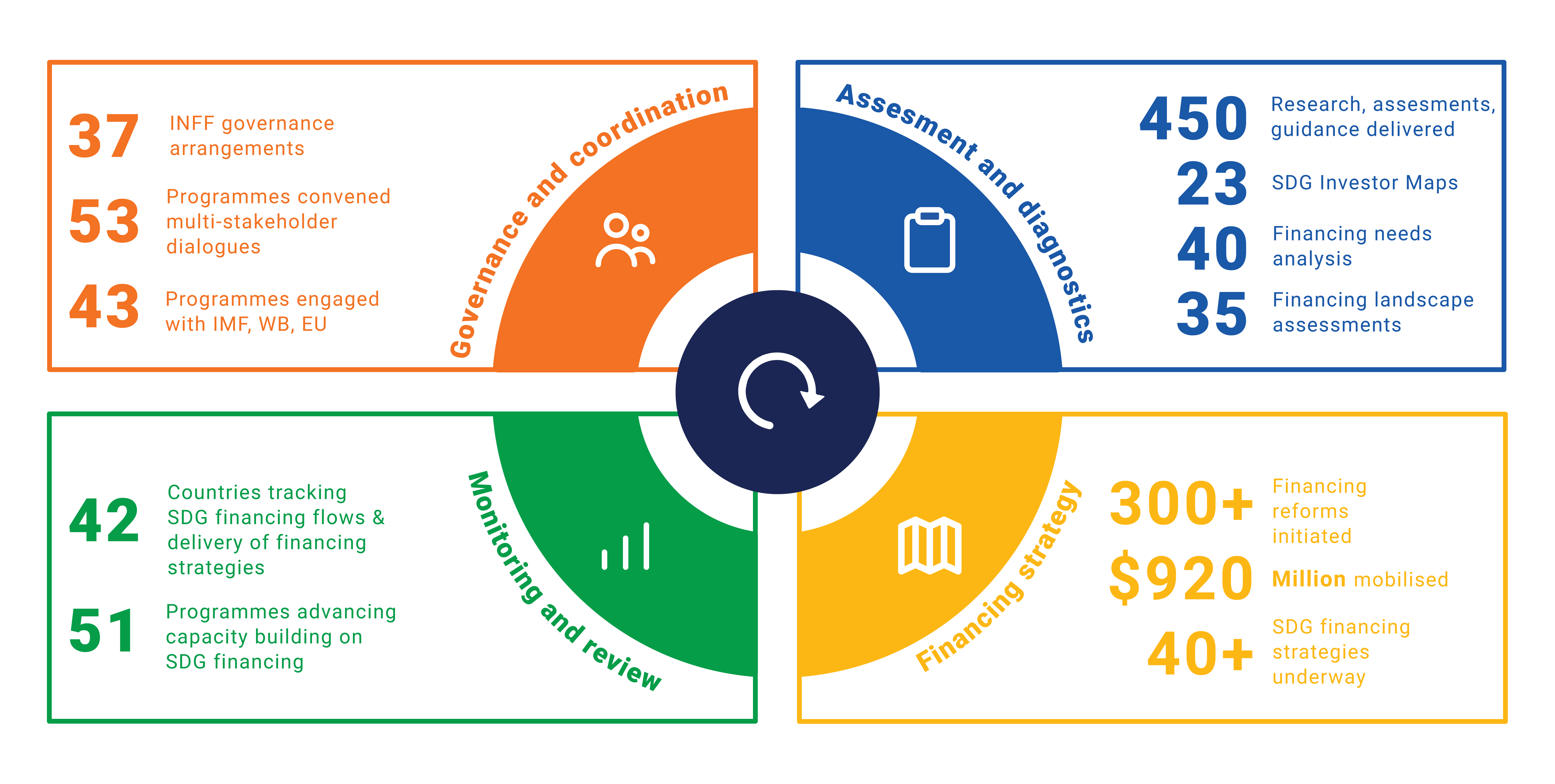

Enabling Environment for SDG Financing portfolio: a new wave of SDG-aligned financing strategies –the Integrated National Financing Frameworks– is co-created in 80 countries. We help countries define the financing behind their development priorities, encompassing over 200 financial reforms in budgeting, taxes, public-private partnerships, access to finance and capital markets.

-

Catalytic Investment portfolio: public and private financial capital is blended to progressively reach scale in the mobilization of capital for the SDGs. Preparatory grants led to the design of 59 blended finance solutions in 34 countries. Catalytic grants provide de-risking and technical assistance solutions has unlocked US$ 1.45 billion in 2021.

Blue Economy

Blue Economy

Blue financing solutions to preserve marine resources and coral reefs while offering income opportunities to coastal communities. Fiji and Papua New Guinea fit into this theme.

Social Impact

Social Impact

Financing solutions for social impact including health, education, waste, water, and sanitation to improve the well-being of people and communities, especially vulnerable groups. Kenya fits into this category, with a focus on gender equality and health.

Food Systems and Agriculture

Food Systems and Agriculture

Financing solutions for sustainable agriculture systems and enhanced food security. These include microcredit and microinsurance, downscaling schemes from multilateral development banks, and blended finance facilities supporting agricultural supply chains, smallholder farmers, rural development, nutrition, and sustainable farming transitions. Malawi and Suriname fit into this category.

Energy and Climate Action

Energy and Climate Action

Green financing solutions for renewable and more efficient energy systems and climate action. These include green financing solutions, from green lending and impact investing to insurance and smart subsidies. Indonesia, Madagascar, North Macedonia, Uruguay and Zimbabwe fit into this category.

Partnerships

Lisa.kurbiel [at] un.org (Get in touch)